On 20 September 2022, BASIC published a study on the cocoa and chocolate value chains in Germany. The analysis was commissioned by the European Commission’s Directorate-General for International Partnerships (DG INTPA), the FAO Investment Centre and the secretariat of the German Initiative on Sustainable Cocoa (GISCO).

There is little work available to estimate and understand the creation and distribution of value, costs, taxes, and therefore net margins along the cocoa and chocolate value chains. Yet this information is of growing interest to industry players in the context of international discussions on the income needed for farmers to survive, as well as the fight against deforestation and child labour.

These issues are of particular concern to the European Union, a region that accounts for 55% of global chocolate consumption and around 40% of cocoa grinding. In 2019, DG INTPA, the FAO Investment Centre and ECA initiated a first step by asking BASIC to develop a model for the creation and distribution of value, costs and net margins for chocolate products marketed in France. The results were published in July 2020.

Following this publication, the secretariat of the German Initiative on Sustainable Cocoa (GISCO) contacted BASIC to develop a similar model and study for the German market.

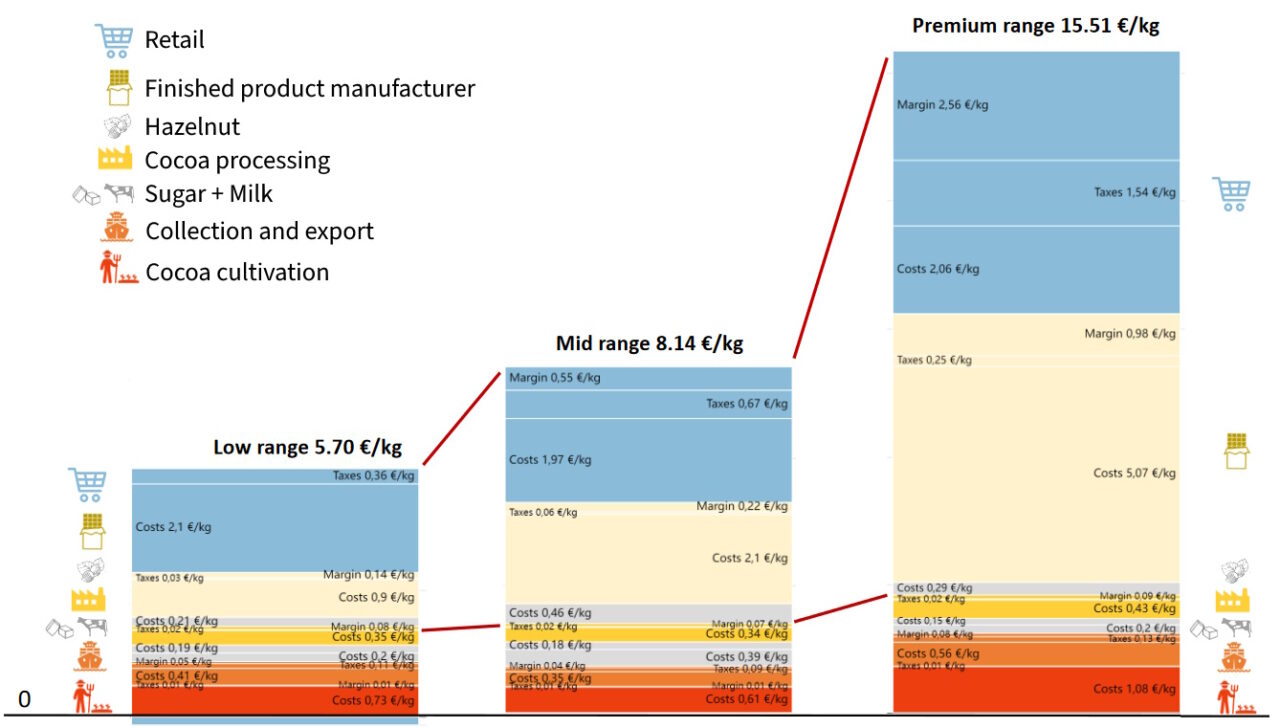

The study revealed a disconnection between the final price of products and the income of cocoa farmers. The price paid by consumers depends more on marketing than on the cost of the raw material. For example, for a bar of chocolate (100g) from a national ‘entry-level’ brand, sold on average at 0.57 euro (or 5.70 euros per kilo), just as for a top-of-the-range bar, sold on average for three times this price, the farm’s net margin is very low, if not non-existent.

The difference lies essentially in the net margin generated by the companies manufacturing the final product (multiplied by seven between the two products) and by the distribution sector, which goes from a negative net margin to a positive net margin of almost 26 cents per tablet sold.

The German market differs from the French market in that Germans prefer sweeter milk chocolates, while hard discounters are driving down the price of entry-level chocolates.

On the same topic: